Layer 2 Solutions | Ethereum

What are Ethereum Layer-2 Scaling Solutions?

We’ve already covered layer-2s at length in other articles. So, if you need an introduction, please read our “What are Layer-2 Solutions?” article. For now, the simplest way to explain layer-2 solutions is that they help Ethereum scale by speeding up transactions and making them less expensive. More importantly, the question is, how can you benefit from these layer-2 scaling breakthroughs?

İçindekiler

This article will cover four promising layer-2 solutions: Arbitrum, Optimism, StarkNet, and zkSync. Furthermore, we’ll explore their forthcoming layer-2 tokens. 2021 was the foundational year for layer-2s, and 2022 could be the year they take flight. When they do, these four projects will likely play a key role.

Layer-2 Solutions – ZK-Rollups and Optimistic Rollups

There are two types of rollups occupying the layer-2 solutions space: zk-rollups and optimistic rollups. While both serve to scale Ethereum, they do so in different ways. However, while both are breakthrough solutions, none other than Vitalik Buterin, Ethereum co-founder, believes that zk-rollups are the more promising solution in the long term.

Two teams making incredible progress with zk-rollups right now are StarkWare and Matter Labs, which we’ll look more into later on. Moreover, Ethereum is the layer-1 blockchain that layer-2 solutions serve. So, to learn more about Ethereum, join Moralis Academy and take the Ethereum Fundamentals course today!

StarkWare – StarkEx and StarkNet

StarkWare is pushing scalability limits with two layer-2 solutions that show great promise: StarkEx and StarkNet. StarkEx is a scalability solution that StarkWare released in 2020. Besides the zk-rollup mode, StarkEx has another operating mode called “validium.”

Validiums are custom designed for the particular dApps that will employ them. However, in the future, StarkEx will offer a third option for users to decide on the spot whether they want to go with a zk-rollup or the validium experience.

Some of the projects already using StarkEx are dYdX, DeversiFi, and Immutable X.

What is StarkNet?

StarkWare is also developing StarkNet, another layer-2. StarkNet is a decentralized zk-rollup compatible with Ethereum Virtual Machine (EVM). It accomplishes compatibility through a compiler to Cairo, its programming language.

The team designed StarkNet for general-purpose computation. So devs can either create dApps in Cairo or port over Ethereum code via its Solidity-to-Cairo compiler.

StarkNet Alpha launched on the Ethereum mainnet in November 2021, so it’s still fairly new. However, since StarkWare is putting lots of development muscle behind StarkNet, it looks to be one of the promising scaling solutions for the future.

In sum, StarkWare’s layer-2 solutions are powerful technologies still in their early phases. But, by familiarizing yourself with these layer-2s now, you can better prepare for the future.

zkSync – Ethereum Layer-2 Scaling Solutions

Another layer-2 solution that brings quicker and inexpensive transactions to the Ethereum blockchain is zkSync. This project promises more good news for Ethereum users who are ravenous for lower fees. Further, zkSync succeeds by moving most activity off of layer-1 while still inheriting its security benefits.

Matter Labs developed zkSync. Like StarkWare, zkSync belongs to the zk-rollups class. Since zkSync uses similar technology, it is also adept at defying congestion and becoming less expensive as more people join the network.

As those using Ethereum can tell you, layer-1 platforms become more expensive with network congestion. So, zkSync is providing a much-needed service.

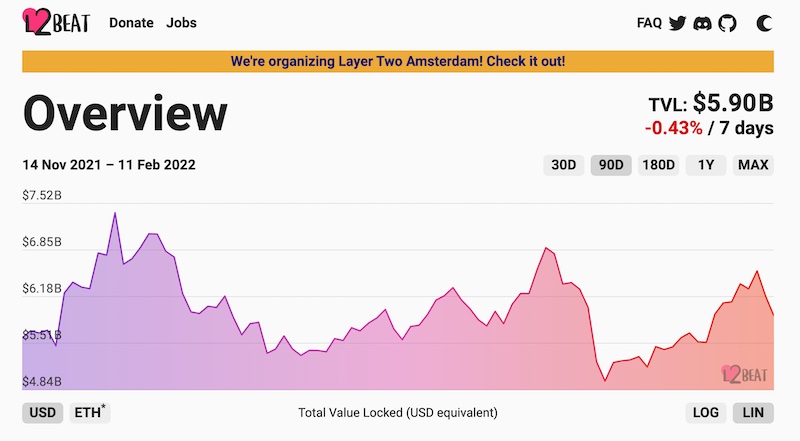

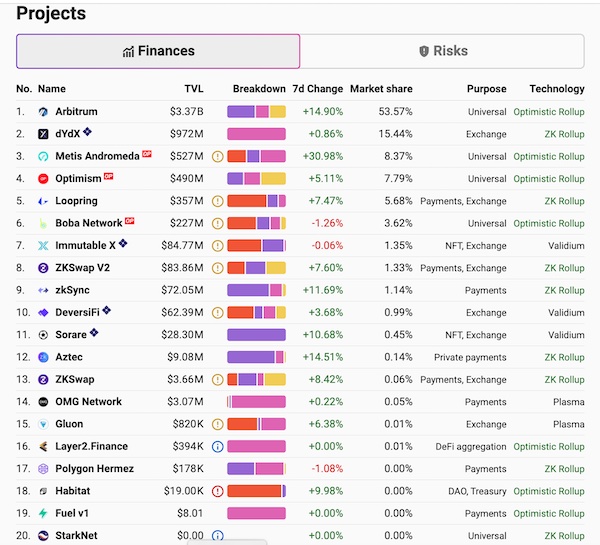

At the time of writing, it stands in ninth place for layer-2 solutions with over $70 million in total value locked (TVL), according to L2BEAT. That number will likely grow as zkSync’s features advance, attracting more users seeking lower transaction fees.

Arbitrum – Ethereum Layer-2 Scaling Solutions

Offchain Labs created Arbitrum. It is an optimistic rollup that is EVM-compatible. That makes it easier for NFT and DeFi protocols to port their code to it.

This kind of compatibility helps explain why Arbitrum is the most prominent layer-2 solution with just over $3 billion in TVL. Moreover, long wait times for withdrawals are one of the challenges with optimistic rollups. So, for quicker deposits and withdrawals, you can use bridges such as the Hop protocol, Synapse, and xPollinate.

Optimism – Ethereum Layer-2 Scaling Solutions

As you might have guessed, Optimism is also an optimistic rollup. It currently ranks fourth in terms of layer-2 TVL and offers full Ethereum Virtual Machine (EVM) compatibility. That means DeFi and NFT developers can port their dApps over to layer-2 with one click.

Liquidity bridges to shorten the seven-day waiting period for optimistic rollup withdrawals exist. For example, you can fund Optimism with Argent, the Hop protocol, and Celer Network, to name a few.

Are you ready to learn more about crypto? Read about the blockchain in supply chain and Web3 browsers at Moralis Academy’s blog.

Exploring Layer-2 Tokens

Surprisingly, the prominent layer-2 solutions this article covers (Arbitrum, Optimism, StarkWare, and zkSync) all remain “tokenless.” On the other hand, maybe it’s not surprising when considering the technological feats involved in creating such cryptographic complexity.

Some analysts predict that by 2023, two or more layer-2 tokens will breach the top ten cryptos by market cap after launch. To do that, they’ll need to compete with alternative layer-1 solutions. New layer-2 tokens bundled with incentives like airdrops could help fuel this technology.

That means that the likelihood of a token launch by at least one of these four is high. That is good news for early adopters, who could potentially receive layer-2 tokens in the airdrops.

Layer-2 Tokens – Why the Wait?

Unfortunately, layer-2 solutions still have technical hurdles to cross before launching any tokens. For one thing, the space needs better layer-1 to layer-2 bridges. So that’s why these projects are likely to postpone token launches until that time.

But when they do, tokens should start rolling out in late 2022 through 2023. Whenever it happens, zkSync will probably lead the pack. It is the top contender for a token launch since it’s already confirmed its commitment to community ownership.

At the opposite end of the spectrum is Optimism. Its team has publicly denied it will launch a token. StarkNet, on the other hand, is taking the middle road. It has neither confirmed nor denied that a token is in its future. Arbitrum also says it has no plans for a layer-2 token.

However, making public pronouncements one way or the other isn’t as important as a platform’s need to incentivize liquidity. Incentives will come. It’s just a matter of what kind.

The probability of upcoming layer-2 tokens opens the door to more questions such as how will layer-2 tokenomics work? What kinds of incentives will they offer? How will they allocate their tokens? More importantly, if incentives take the form of airdrops, how much will go to the community and loyal users?

Layer-2 Tokens – zkSync Token Allocation

No one has the answers at this point, but zkSync already announced it would distribute 67% of its tokens to the community. If that’s the case, a zkSync token could set the standard for the competition.

So, what does that mean for those looking to front-run any zkSync token launches? To get included on any airdrops means you will have to use the associated protocols in some form or fashion. For example, you could transact on layer-2 dApps, use a bridge, or build new dApps on a layer-2 solution.

If you’re not a developer, then focusing on the first two – transacting and using bridges – will be the more accessible approach. For starters, you could migrate some of your DeFi and NFT action over to layer-2. Below, let’s examine some specific ways to get a shot at a zkSync token drop or other layer-2 tokens.

Do you want to learn about DeFi? Make sure to take the Master DeFi in 2022 course at Moralis Academy.

Layer-2 Tokens – Some Action Steps

Now is an excellent time to prepare for any possible upcoming rollouts. So, let’s look at some of the ways to do that.

Layer-2 Solutions – Arbitrum

Once you’ve selected a bridge to fund your Arbitrum account, the next step is to explore some of the dApps available:

1. Uniswap

Provide liquidity on Uniswap.

2. Curve

Likewise, you can also provide liquidity in Curve’s tricrypto pool.

3. Balancer

Provide liquidity on Balancer.

4. Badger

Add funds to Badger’s DeFi vaults.

5. Pickle Finance

Yield farm your liquidity provider tokens on Pickle Finance.

Layer-2 Solutions – Optimism

After funding your account, some dApps to explore with Optimism are:

1. Uniswap

Trade or provide liquidity on Uniswap.

2. Lyra

Trade options on Lyra.

3. ZipSwap

Yield farm on ZipSwap.

4. Thales

Trade options on Thales.

Layer-2 Solutions – StarkEx and StarkNet

For now, you can try dYdX, Immutable X, or DeversiFi.

Furthermore, dYdX is a decentralized derivatives platform that relies on StarkEx. Because of this relationship, dYdX users experience quick, inexpensive, and trustless transactions. Immutable X is the self-proclaimed “first layer-2 for NFTs on Ethereum,” while DeversiFi is a decentralized exchange (DEX).

Notably, StarkNet hasn’t finished its audits yet. Nevertheless, if you’re the pioneering type, there are some riskier trial runs for you to explore. Remember to always proceed with caution when testing out new platforms and protocols. You don’t want to risk large sums of cash. But when you’re ready, you can use:

1. Mint Square

Mint an NFT on Mint Square.

2. Argent Wallet

Create an Argent X wallet and mint test tokens.

3. Briq

Build Briq NFT sets.

4. IBetYou

Try some test bets on IBetYou.

Layer-2 Solutions – zkSync

When the zkSync token launches, it will serve as another liquidity magnet. Matter Labs stated, however, they’re not in any rush to release a zkSync token. But, if the zkSync token piques your interest, you can start using the platform now.

How to Get the zkSync Token

The Ethereum economy is moving towards zk-rollups. While still in their earliest phase, zkSync already demonstrates what zk-rollups can do. Some dApps such as zkNFT and ZigZag are also extremely new and in the experimental stage. Further, ZigZag is still not audited, so proceed with caution.

Here are five options to check out:

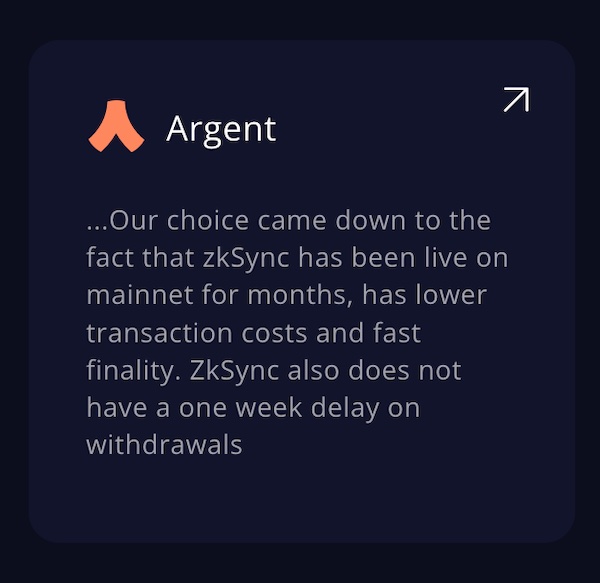

1. Argent Wallet

One of the innovative features of Argent is that it lets you choose “guardians” who can help you recover your wallet should you ever lose access to your wallet’s signing key. This feature will help onboard “noobies” to crypto who might otherwise be afraid of losing access to their crypto wallet.

Argent chose zkSync for its layer-2 wallet launch. So, you can create your zkSync wallet by simply going to Argent. First, fund your account, then you can try some of the built-in app integrations.

2. Gitcoin Donation

You can also make a Gitcoin donation, and after selecting your project of choice, choose the “checkout with zkSync” option and follow the instructions.

3. ZigZag Exchange

ZigZag is a decentralized exchange that has built its reputation by being the first DEX to go live on zkSync. It serves as the trading center for zkSync at the moment.

5. Mint with zkNFT

To experiment with NFT minting, you can create a wallet on the main zkSync website. Or you can use zkNFT’s minting function.

Have you ever asked the question, “what is Litecoin?” Follow the link to learn more. While you’re at it, learn the difference between Cardano vs Solana to find out which blockchain is better!

Layer-2 Solutions and Tokens – Final Thoughts

Do you ever wish you had been an early adopter for some of the more successful protocols and platforms out there today? Hindsight is 20-20. However, becoming an early adopter in the present involves foresight and risk.

Such risks include financial ones, but you can mitigate them by limiting your trading amounts. However, there is another risk – time. Using dApps that you’re not necessarily interested in to earn some potential layer-2 tokens in an airdrop can be a complete waste of time. What if the airdrop never comes? Spending months on a layer-2 solution that never drops a token could end up being a huge time suck.

So the challenge becomes picking the winning horse. The zkSync token appears to be a done deal, but other promising layer-2’s will also launch their native tokens. At the end of the day, if you want a shot at earning layer-2 tokens, you’ll need to do your due diligence to predict which ones will offer airdrops to its loyal users. It’s a difficult challenge, but doing anything worthwhile always is.

Predicting which layer-2 solutions will launch a token might be a tough challenge. But predicting which future careers will be prosperous is much easier. Learn how to become a blockchain developer and prosper in this red-hot job market. Join Moralis Academy today!